How to Set Magento Tax Rules

Managing taxes on an ecommerce store can be complex, but Magento makes it easy with its flexible tax rules system. Tax rules allow you to define customized tax logic for factors like product type, customer group, and geographic location.

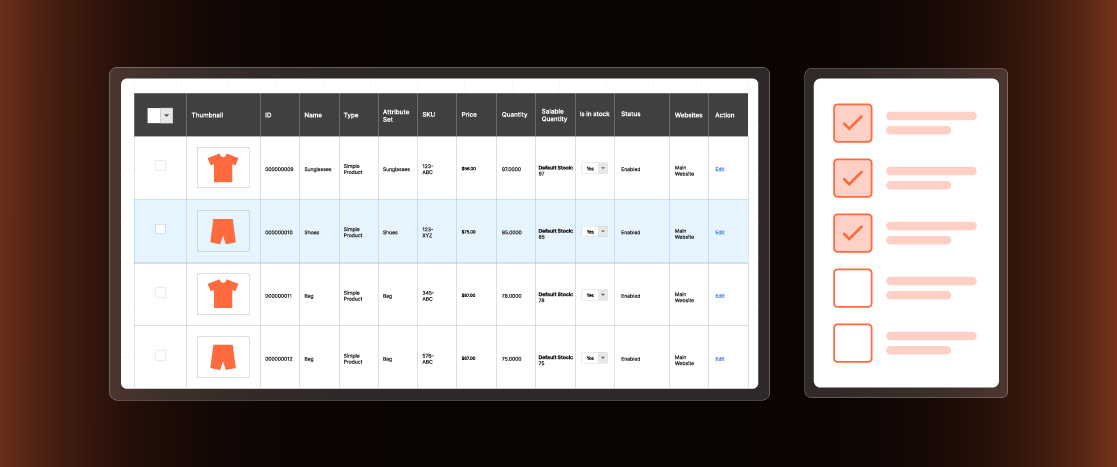

The key is that each product and customer is assigned to a class, such as “clothing” or “wholesale.” Magento then uses tax rules to specify how different combinations of product and customer classes should be taxed in various regions and tax jurisdictions.

For example, you could create a tax rule that clothes are tax-free for wholesale customers in Florida. But retail customers would still be charged sales tax on clothing in Florida. The tax rules allow you to handle complicated tax scenarios like this easily.

Magento evaluates the items in the shopping cart, checks the assigned product and customer classes, and selects the applicable tax rates for each region. This automated tax determination streamlines the entire taxation process.

The benefit for merchants is the ability to configure precise tax logic for all products and customer types. Tax rules eliminate the need for complex coding and let you handle taxes flexibly through the Magento admin. This simplifies tax management, even for stores with complex tax requirements.

Magento Tax Rules – Setup Taxes in Magento 2

As discussed above, taxes can get complicated, but Magento 2 makes it easy to handle complex tax scenarios. The key is setting up flexible tax rules that allow you to apply customized tax logic.

Configuring taxes in Magento 2 is easy; follow these steps:

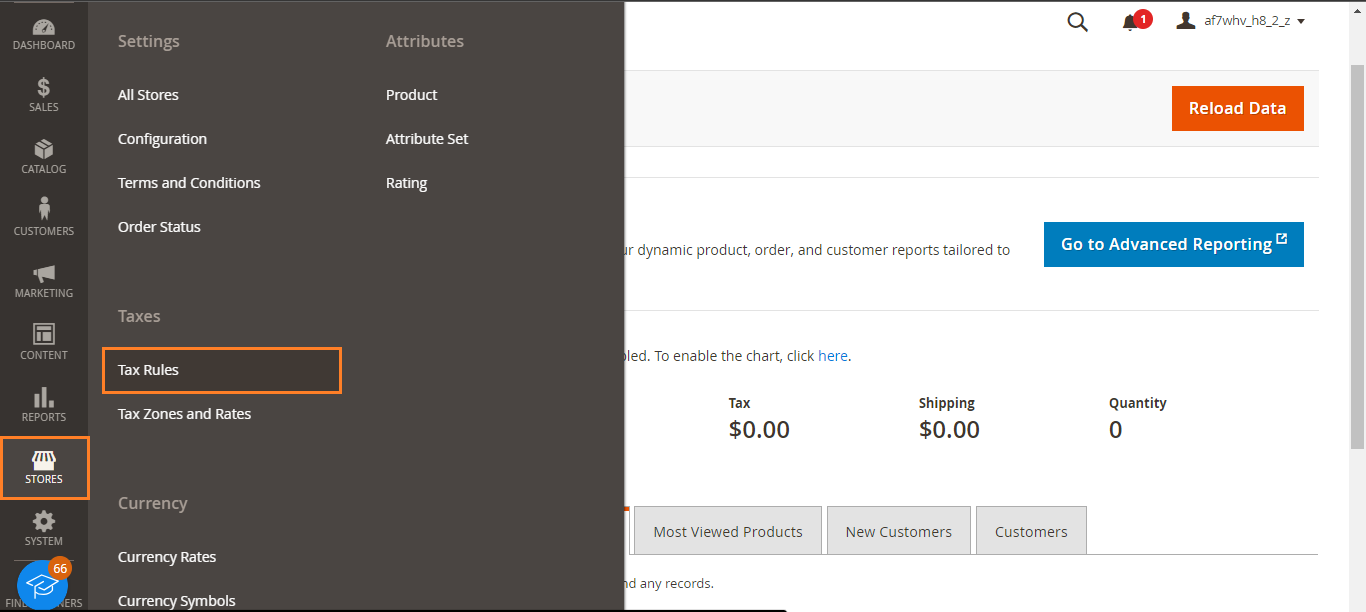

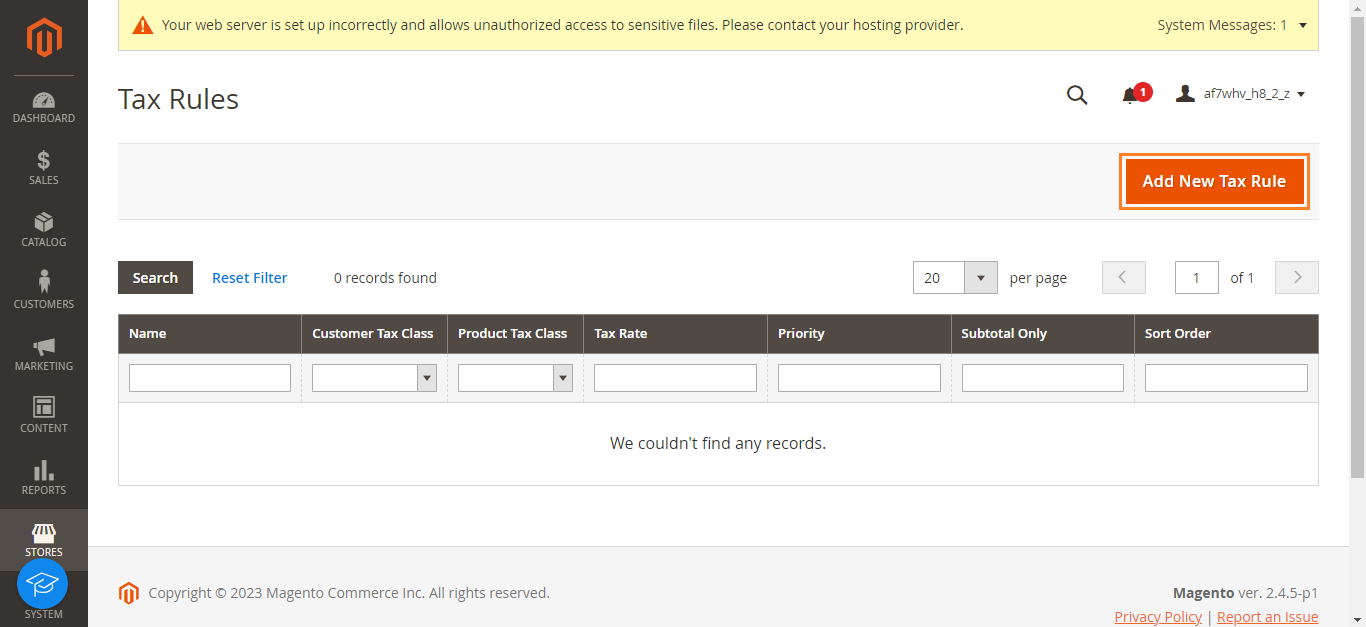

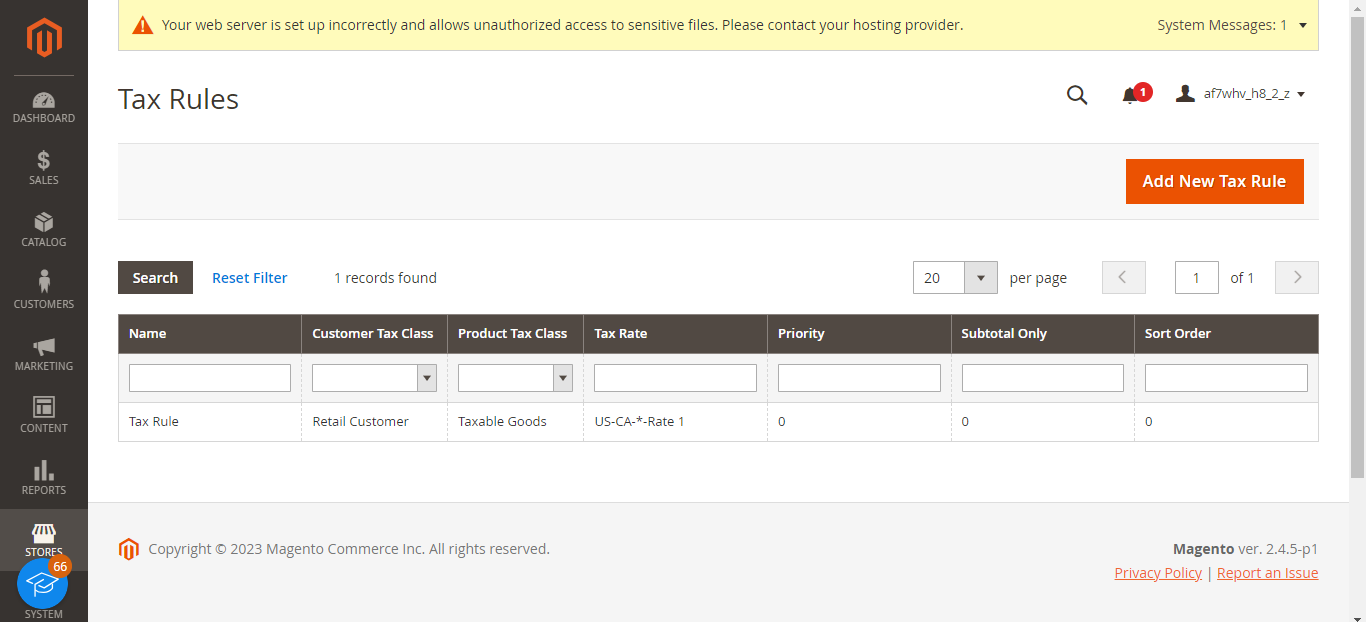

- Log into your Magento 2 admin and navigate to Stores > Taxes > Tax Rules.

- Now, click the “Add New Tax Rule” button.

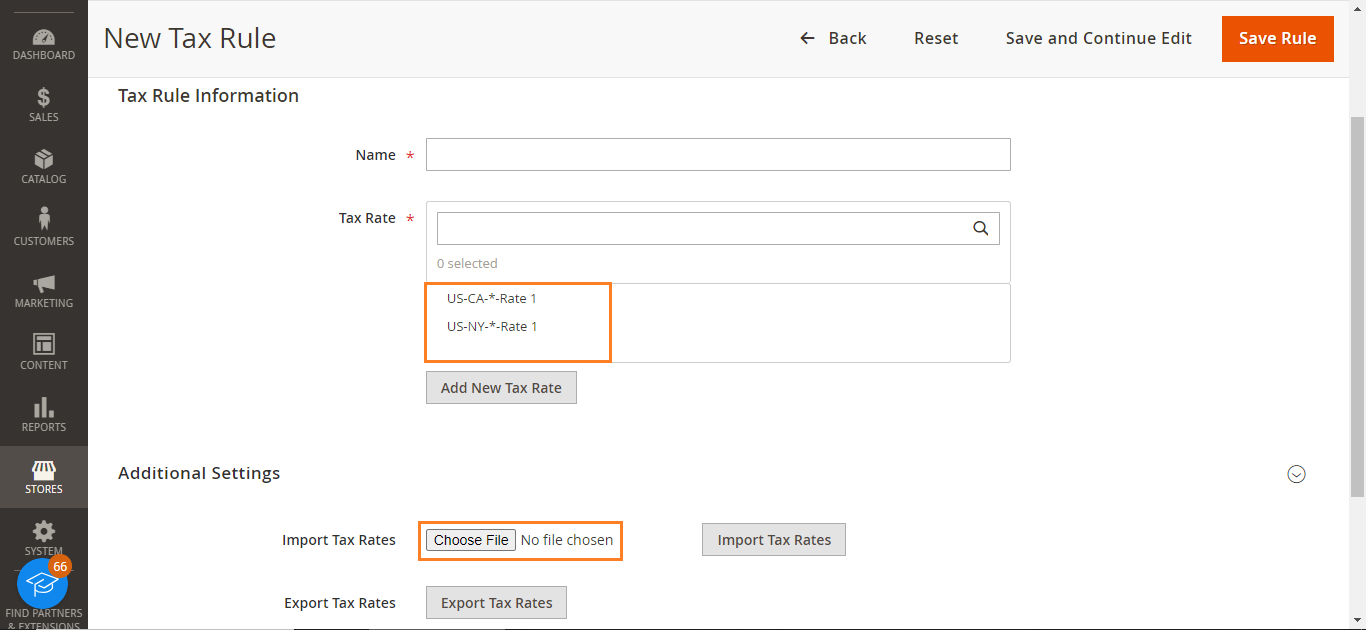

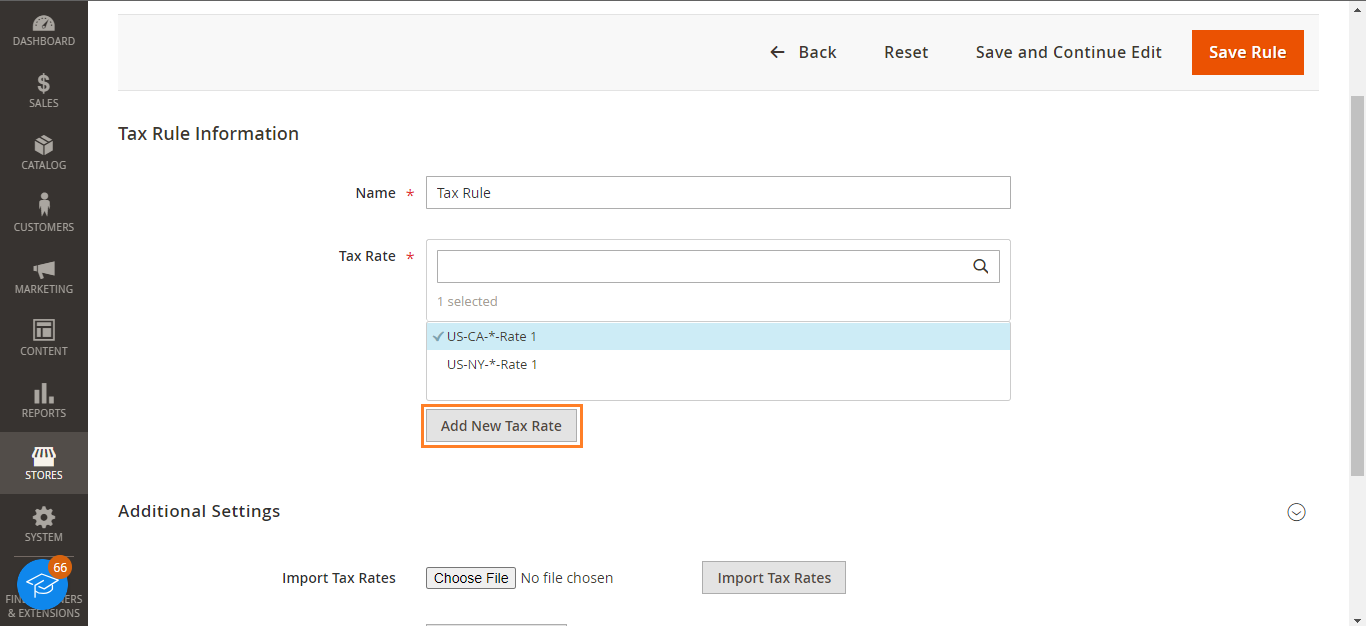

- Enter a tax rule name and description to help you later identify the rule.

- Then, select a tax rate to apply or “Import Tax Rates” by uploading a CSV file.

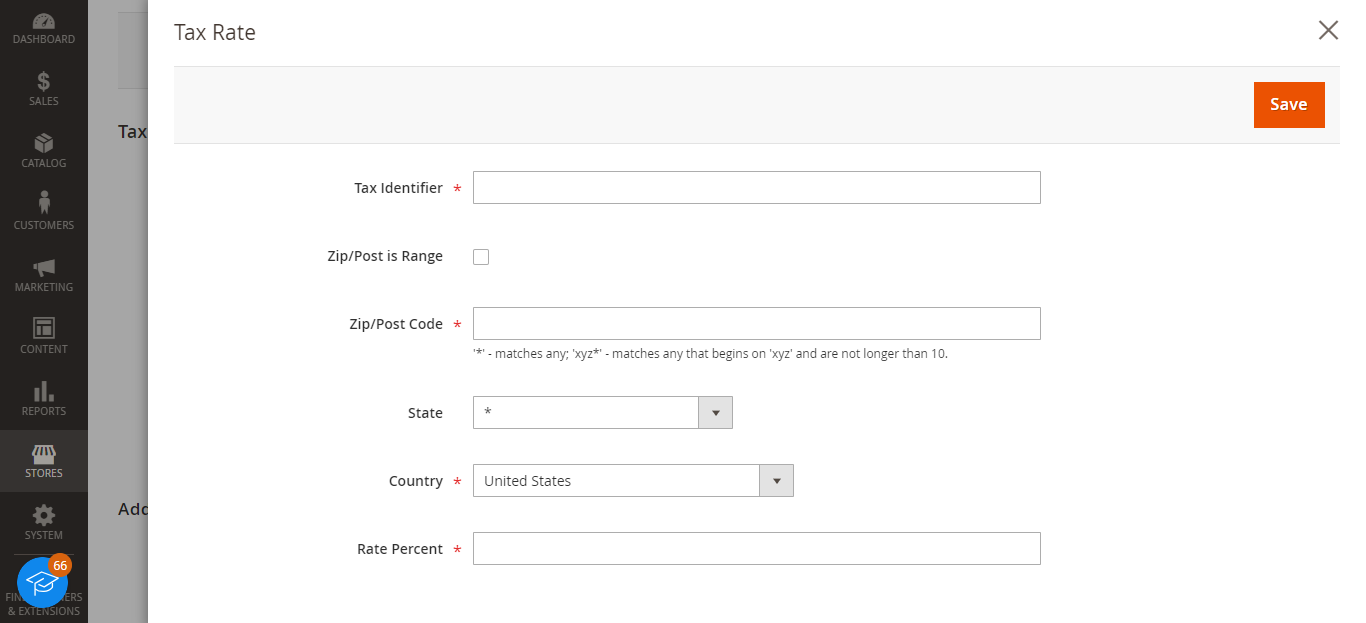

- Or you can add a new rate by clicking the “Add New Tax Rate” button.

- Enter all the details, and do not forget to save any new rates you create.

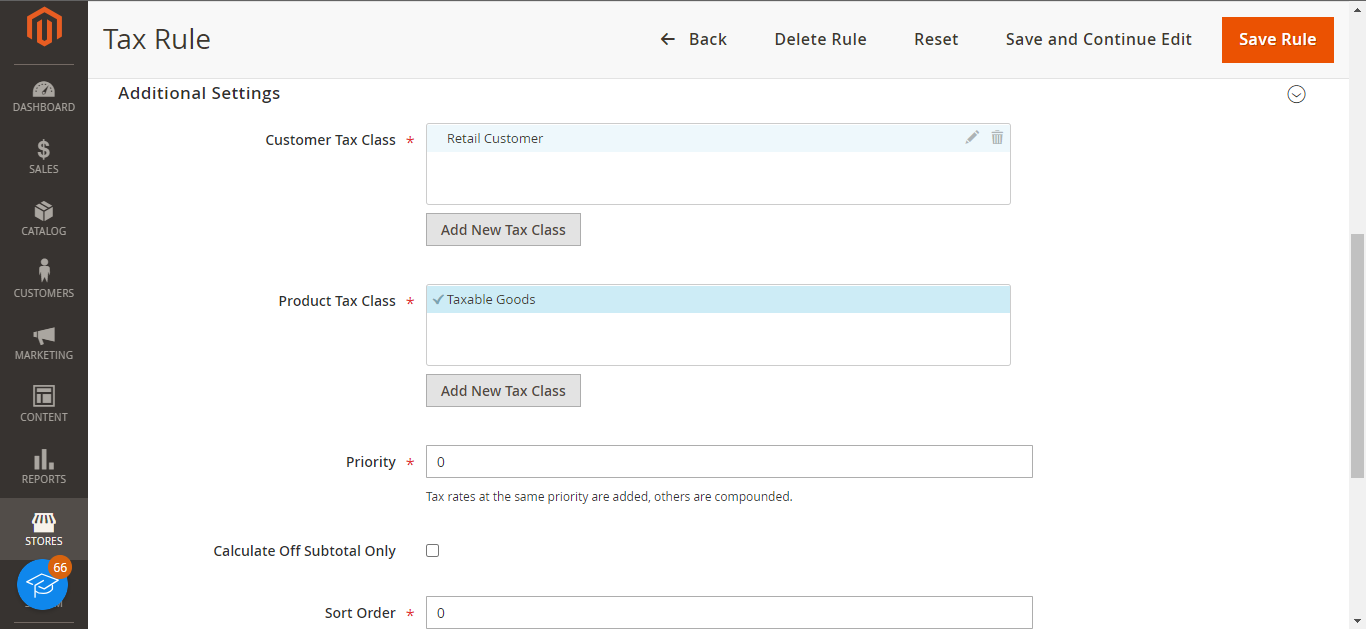

- Assign a customer tax class and a product tax class. These determine which customers and products the rule applies to. Click the edit icon to modify classes.

- Set the priority level. This controls the order if multiple rules apply. The same priority rules are combined. Different priorities are compounded sequentially.

- Choose if this rule calculates based on subtotal only. This excludes things like shipping costs.

- Enter a sort order number to list this rule logically with others. Lower numbers appear higher in the list.

- When finished, save your tax rule. It’s now active and ready to handle your tax scenarios.

- Create additional rules as needed for your other tax situations. Magento 2 makes it easy to handle even complex tax requirements.

The benefit of following these steps is the ability to set up flexible, customized tax logic for all your customers, products, and regions. Magento 2 tax rules are powerful and can handle your most complex tax needs.

Conclusion

Magento tax rules are a powerful feature that allows merchants to configure customized tax logic for all products, customers, and regions through the admin dashboard. This eliminates the need for complex coding to handle even the most complicated taxation scenarios. Automated tax calculation at checkout provides a seamless customer experience.

If you are looking for a cloud hosting platform for your Magento store, check out Devrims Managed Magento Hosting.